What Fragrances Have in Common with Diapers or A New Approach to Consumer Segmentation

Today, we explore what ideas, strategies and tactics are underutilized by perfume brands, and how to segment niche perfume customers more effectively.

Ideally, brand strategy in fine fragrances should start with defining the product category. This determines a lot of aspects down the road, including positioning, pricing, acquisition vs. retention strategy, promotion, and more. And it is not always as straightforward as it seems.

Not having a category well defined leads fragrance brands to focus on trends in the most obvious adjacent category – beauty. They also tend to borrow strategies and marketing approach (and last but not least – talent) from beauty, when in reality, fragrances often have much more in common with other categories.

As an example, let’s take the diapers category.

On the surface, it looks like a regular FMCG product: it is sold in supermarkets, sometimes in the same aisle as feminine care or toilet paper. It has a package, is purchased frequently, sells quickly, has a relatively low cost, and is disposed of after each use. On the other hand, it has to do with the most precious – a baby; it contributes to the mother-baby bonding experience and can sometimes cause skin rash, so it is not as prone to impulse purchases as a regular FMCG product. In fact, parents are often extra careful when picking their next box of diapers and do a lot of research on brands. This makes it closer to durables, and it’s a whole other story in terms of brand strategy and deciding how to use the marketing budget.

Perfume, especially in the niche segment, is an interesting category as well:

It is applied on the skin and is designed to make someone more attractive. It also has a functional element to it (can freshen you up). So, it does make sense to draw parallels with beauty. However…

Creating it requires creativity; it can be inspired by abstract ideas, hold historical significance, be admired, and have zero practical use – just like art objects.

It can be an object of conspicuous consumption and appreciate in value over time – just like the luxury category as a whole.

It adds to someone’s personal style or makes them feel like “someone else” – much like fashion or lifestyle products.

It can be treated as an element of interior design – just like furniture or a piece of décor.

It is a sensory object – which makes it close to the wine and spirits category.

Finally, it can be used for entertainment or mood lift – just like music, games, collectibles, or wellness products (think about escapist fragrances that transport us to a different place, mood, or state; fragrances that evoke personal memories or trigger nostalgia for scented products from the past; the whole experience of collecting fragrances).

If you think about it, niche perfumery shares more in common with some of these categories than with the broader beauty industry. It makes sense, then, to observe trends and market motions in these categories and, when appropriate, borrow ideas, strategies and best practices. Leveraging elements that have been traditionally underutilized in perfumery can help brands innovate in marketing strategy, creative concepts, and promotional tactics.

That said, this is not the only way in which comparing fragrances to other categories can be helpful. It can also serve as a framework for consumer segmentation (though likely only in the niche/indie/artisanal segments).

Traditionally, companies in the fine fragrance industry have been clustering customers based on demographic and psychographic characteristics, general attitudes and motivations, the so-called “need states”, shopping behaviors, consumption habits, taste and experience with fragrances, and other factors. These variables are typically fed into a statistical model in hope that clusters of customers sharing similar characteristics across most of these variables will naturally emerge in the analysis. Each cluster is then assigned a name and described by an “average customer” profile, often referred to as a “persona”. The segmentation is then handed over to marketers who are tasked with creating products and campaigns targeting each segment individually.

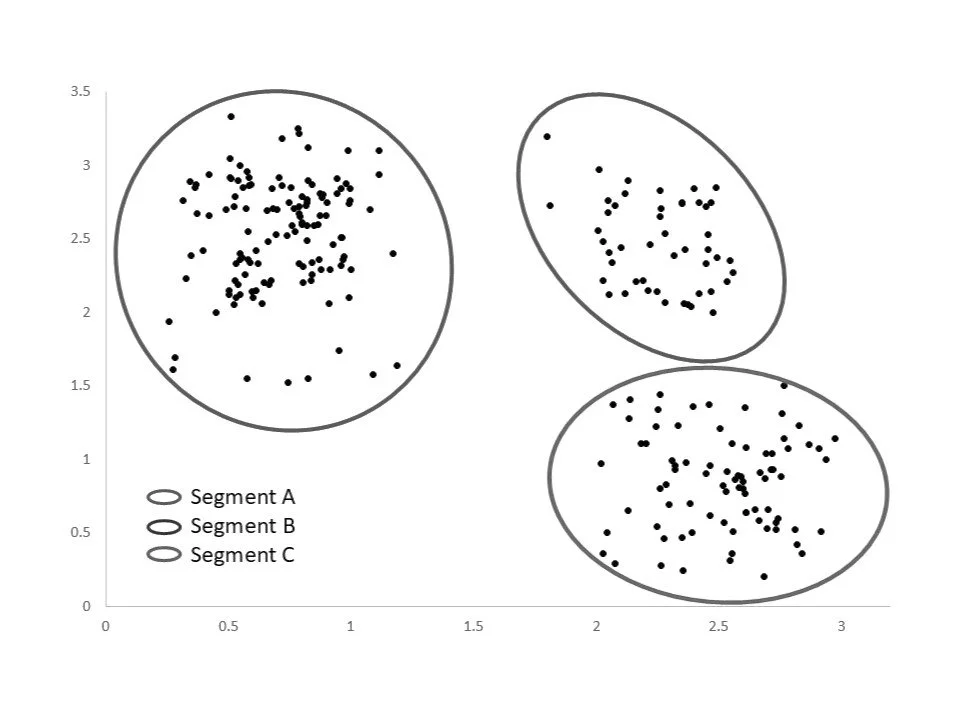

The problem with this approach is that it often misrepresents the motivations of individual customers within each segment. While segmentation works in theory, in practice, individual customers are often quite different from the average portrait of their segment. To make things worse, it is often impossible to precisely target customers based on their segment affinity. You know Segment A customers are out there but don’t know how to identify them. The targeting tools offered by media platforms (demographic characteristics, search keywords, behavior on the platform, etc.) almost never work as intended.

In niche perfumery, this standard approach to customer segmentation is even more problematic. Using different product and promotion strategies for different segments almost always dilutes the brand, makes it seem less niche.

Targeting just one core segment may work better, but it is also rarely effective in creating a coherent strategy, creative concept, and promo tactics, given how the segments are created. The root of the problem often lies in trying to use too many variables as an input for segmentation. A better solution is using just one variable that is highly predictive of all other things brands may want to know about their customers.

Based on multiple conversations with niche fragrance customers, we have landed on one key factor that is highly predictive of purchase motivations, customer expectations from perfume brands, and the size of commercial opportunity. This factor is what role perfume plays in customers’ life (which very closely aligns with the categories we discussed above – art, sensory, style/image, entertainment, etc.). Even though life is rarely black-and white, and it is often true that customers view perfume differently at different points in time, they are usually still able to pick one main category when asked about the role of perfume in their lives.

While some of these categories are relatively straightforward in terms of the brand strategies they align with, others are more nuanced. With this, we start a series of articles on different ways niche perfume users can be clustered based on how they view perfume as a category.

For a deeper dive into different segments, read here: